Introduction

Managing your bank account doesn’t have to feel like juggling flaming torches. Sure, it might seem complicated at first—tracking balances, paying bills, keeping tabs on fees—but once you establish a solid routine, it can be as simple as a quick morning stretch. Think of your bank account as the heart of your financial body. It keeps money pumping through your daily life, enabling you to pay bills, save for rainy days, and work toward your biggest dreams. In this article, we’ll dive into the nuts and bolts of bank account management and explore tips to help you stay on top of every transaction and fee, all while keeping it straightforward and stress-free.

Understanding bank account management

Bank account management is all about overseeing the flow of funds into and out of your account. It starts with depositing income, whether that’s your paycheck from a day job or earnings from a side hustle. Then, it expands to tracking your expenses, fees, and the remaining balance after your bills and personal purchases. It’s essentially like the traffic controller of your finances, ensuring money arrives and departs smoothly.

The basics of money flow

Money flow is the foundation of any banking system. You deposit funds, you withdraw funds, and you monitor what’s left over. By paying closer attention to your money flow, you’re effectively taking control of your financial destiny. You get insights into how much you earn, how much you spend, and how much you can allocate toward goals like a vacation, a mortgage down payment, or an emergency fund.

Why it’s important

Properly managing your bank account ensures you’re not caught off guard by unexpected charges or a nasty overdraft notice. It helps you minimize fees, keep your credit score healthy, and avoid the embarrassment of declined transactions. Plus, it sets the stage for organized and responsible financial planning—think of it as the sturdy scaffolding that supports your long-term financial success.

Types of bank accounts

The first step toward good bank account management is choosing the right accounts for your needs. Different types of accounts serve different purposes. Some help you cover daily expenses, while others are designed to help you save and grow your money. Selecting the best account (or set of accounts) can make all the difference when it comes to how well you manage your finances.

Checking accounts

Checking accounts are the go-to choice for day-to-day financial transactions. If you’re using a debit card for groceries, paying for a streaming subscription, or setting up direct deposit for your paycheck, a checking account is typically what you use. These accounts allow frequent transactions with few restrictions, and many offer perks like free checks or no monthly maintenance fees—though this varies from bank to bank.

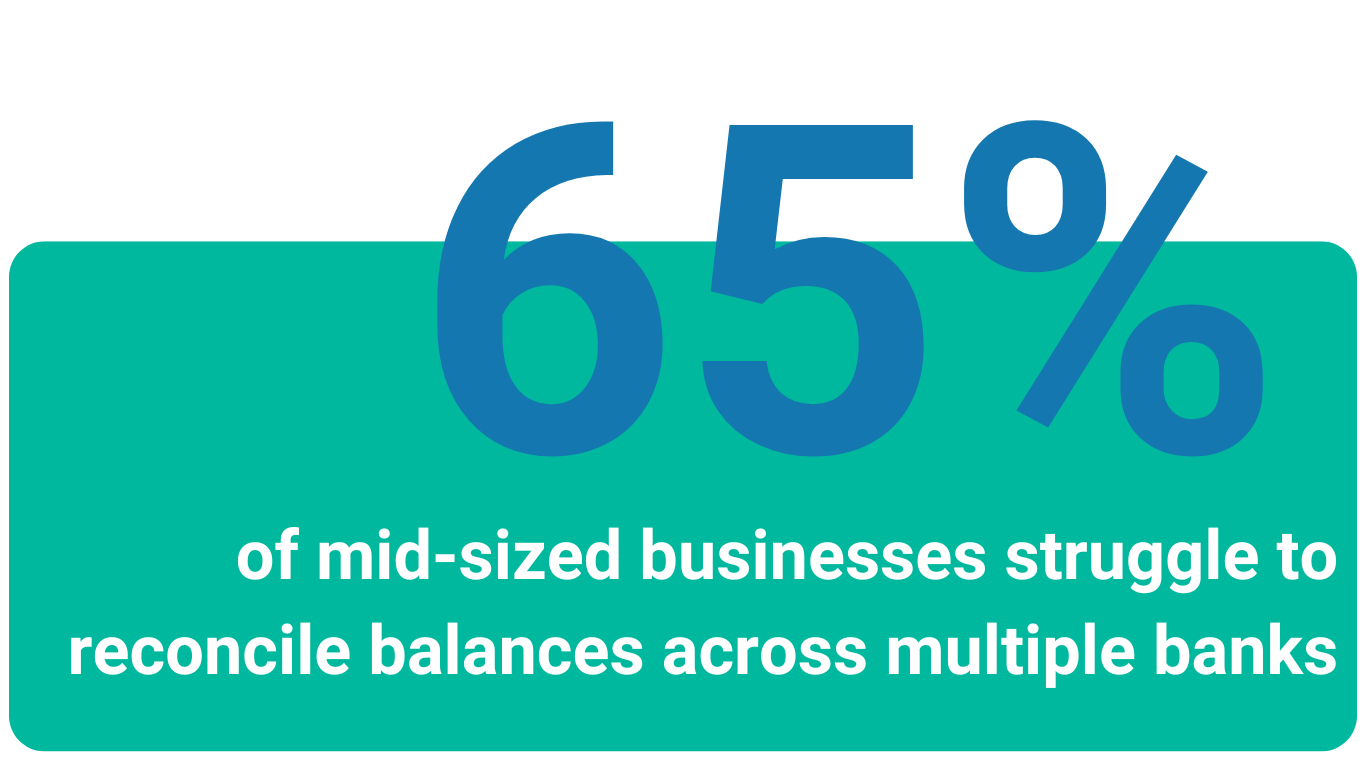

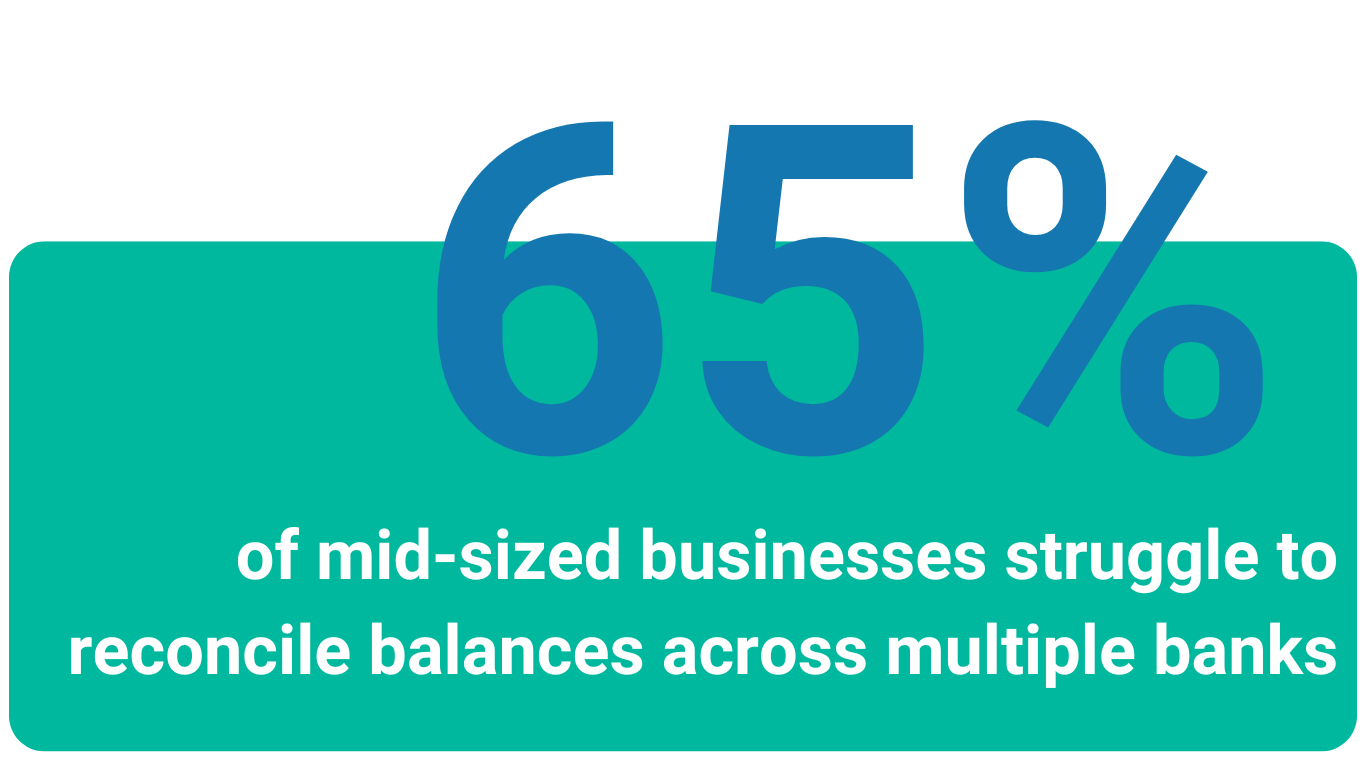

survey by FinTech Trends

When to use

A checking account is ideal for regular spending. Think of it as your main wallet, but in digital form. If you have bills to pay, groceries to buy, or online purchases to make, you’ll likely be drawing from your checking account. While it may not earn much interest, it offers convenience, accessibility, and often, a wide network of ATMs you can use without extra charges.

Savings accounts

Savings accounts are designed to store your money and help it grow—albeit at a moderate rate. Many savings accounts earn interest, meaning the bank pays you a small percentage of your balance periodically. They’re generally more restrictive than checking accounts, limiting the number of withdrawals you can make each month without incurring a fee.

Understanding interest rates

Interest rates are key to turning your savings account into a growth tool. Different banks offer varying rates, and online banks sometimes offer higher rates because they have lower overhead costs. Think of interest as a small reward for your discipline in saving. Even if the rate seems modest, these earnings can accumulate over time, especially if you make consistent deposits.

Budgeting and tracking

Budgeting and tracking are like the GPS for your money. You wouldn’t drive across the country without a map or directions, would you? The same principle applies to your finances. When you create a budget, you decide how much money you’ll allocate to specific categories—rent, groceries, entertainment—so you can track where every dollar goes.

Creating a personal budget

Start by writing down your net income, which is the amount you have left after taxes and any paycheck deductions. Next, list all your monthly expenses, from rent and utilities to that coffee subscription you just can’t live without. Compare your total expenses to your net income. If the expenses exceed your income, you know immediately you need to make adjustments—either by cutting costs or finding ways to increase earnings.

Tracking expenses

After you lay out your budget, it’s time to track your spending. You can do this by using budgeting apps or spreadsheets, or even jotting it down in a notebook. The goal is to always know where your money is going. This might feel tedious at first, but once you get the hang of it, it can be surprisingly empowering. When you see those $5 coffee runs adding up, you might be motivated to brew at home more often.

Avoiding common fees

Banking fees can sneak up on you like an unexpected plot twist in a movie. One minute you’re happily shopping, and the next, you see a ding on your account statement that says “overdraft fee” or “ATM surcharge.” Knowing the most common fees can help you steer clear and keep more of your hard-earned money in your pocket.

Overdraft fees

An overdraft fee occurs when you spend more than you have in your checking account. The bank covers the shortfall and then charges you a penalty for their trouble. This can snowball fast if you make multiple transactions while in the red. To avoid overdraft fees, consider setting up overdraft protection. This often involves linking your savings account to your checking account so funds can automatically transfer if you overspend.

ATM surcharges

Many banks have their own networks of ATMs that you can use for free, but if you wander outside that network, brace yourself for extra charges. Sometimes you’ll get a fee from both the machine’s owner and your own bank. Keep an eye out for machines that clearly display a surcharge fee. Better yet, plan ahead and withdraw from your bank’s own network or a partner network to avoid these hidden drains on your account.

The role of mobile and online banking

Mobile and online banking are like having a personal financial assistant in your pocket. With just a few taps, you can check your balance, pay bills, transfer funds, and set up notifications. If you make the most of these features, you’ll find it easier to stay up to date on your account activity without waiting for a monthly statement or spending time on hold with customer service.

Advantages

The biggest perk of mobile and online banking is convenience. Instead of rushing to a physical branch before closing time, you can handle transactions at your leisure. It’s available 24/7, right at your fingertips. You can also quickly move money between accounts, which is helpful if you notice your checking balance dipping too low. Plus, digital banking platforms often integrate with personal finance apps, making it easier to manage your budget.

Security measures

While digital banking is convenient, it also requires vigilance. Make sure to use strong, unique passwords for your accounts. Consider enabling two-factor authentication for an extra layer of protection. And don’t forget to monitor your account regularly—this way, if something looks off, you can catch it and alert your bank before too much damage is done.

Managing multiple accounts

Some people prefer to have more than one bank account—a checking account for bills and daily expenses, a savings account for emergencies, maybe even a separate account specifically for vacations or major purchases. This can make it simpler to organize your finances, but it also comes with additional responsibilities.

Pros

Having multiple accounts can help you mentally “assign” money to different goals or categories. For instance, you might keep your emergency fund in an online savings account that’s harder to access, ensuring you won’t be tempted to dip into it for impulsive purchases. This approach also makes budgeting easier because you see exactly how much money is allocated for each purpose.

Cons

On the flip side, juggling multiple accounts means juggling multiple sets of fees and minimum balance requirements. You also have more statements and notifications to keep track of. If you’re not organized, having several accounts can lead to confusion, such as forgetting to check the balance in one account or missing a fee that quietly eats away at your savings.

Using alerts and notifications

Alerts and notifications are like a personal alarm system for your finances. They can tell you when your balance gets too low, when a large deposit hits your account, or when a bill is due. They’re highly customizable and can be delivered by email, text message, or push notification on your phone.

Setting up email alerts

Many banks allow you to customize your alert settings through their website. You can typically choose to receive alerts for low balances, large transactions, or even suspicious activity. These email alerts keep you in the loop, especially if you’re not in the habit of checking your account every day.

SMS notifications

Text notifications can be a lifesaver if you’re always on the go. For example, you can set an alert so that every time you make a purchase over a certain dollar amount, your phone buzzes. This keeps you aware of real-time spending and helps you catch unauthorized transactions early.

Monitoring and reconciling statements

Bank statements provide a summary of all your account activity for a given period. Reconciling your statements means comparing them against your own records—like your budgeting app or spreadsheet—to make sure everything matches.

Identifying errors

One big reason to reconcile regularly is to spot errors. Maybe a merchant charged you twice, or perhaps the bank levied an unexpected fee. By comparing your statements to your personal records, you can spot these discrepancies quickly and address them before they become a bigger headache.

Dealing with discrepancies

If you see an error, contact your bank’s customer service immediately. Most banks have a set window of time during which you can dispute charges. The sooner you report a mistake, the faster it can be corrected, and the less stress you’ll have to deal with down the line.

Building a healthy financial habit

Let’s be honest: good habits are the secret sauce to a healthy lifestyle—financial or otherwise. Bank account management becomes second nature when you make it part of your routine.

Reviewing your accounts regularly

Set aside a few minutes each day or each week to peek at your account. Look for any unusual activity or fees. This small step can prevent big problems, like overdrafts or lingering inaccuracies, from wreaking havoc on your finances.

Staying organized

Organization is crucial. Keep your records in one place—whether that’s an app, a spreadsheet, or a dedicated notebook. Label each file and receipt clearly, especially when you have multiple accounts. Treat your finances like a well-structured library, where each expense or deposit has a specific place.

Embracing automation

Automation can be your best friend if you tend to put off tedious tasks like paying bills or transferring money into savings. By setting up automatic transactions, you remove the element of procrastination or forgetfulness.

Automatic bill pay

Most banks offer automatic bill pay services. You can set up recurring payments for items like rent, utilities, or credit card bills. This ensures you’re never late, which saves you from potential late fees and dings on your credit score. Just remember to keep an eye on your balance, so you don’t accidentally overdraft.

Automatic savings

Saving money can be painless if you never see the funds in the first place. By scheduling automatic transfers from checking to savings after each payday, you’re effectively “paying yourself first.” Over time, this approach can build a robust emergency fund or nest egg without you feeling the day-to-day pinch.

Overcoming account management challenges

We all stumble. Maybe you get busy and forget to log your expenses, or you’re tempted to skip checking your balance because you’d rather not face it. Recognizing common challenges is the first step in conquering them.

Lack of discipline

It’s easy to slip into a mindset of “I’ll do it tomorrow.” The trouble is, financial problems can compound quickly. When you feel yourself losing discipline, break tasks into smaller steps. Spend just five minutes reviewing your transactions or adding them to your budget. Little actions pile up, and before you know it, consistent account management becomes a habit.

Fear of checking balances

Sometimes the fear of seeing a low balance can be paralyzing. But ignoring it won’t make the situation any better. In fact, knowledge is power. Even if your balance is lower than you’d like, at least you’ll know where you stand. That knowledge can help you plan, whether you need to tighten your belt for a few weeks or look for ways to boost your income.

Protecting your account from fraud

With the rise of online transactions, the risk of fraud has also increased. Scammers are always looking for new ways to trick you out of your money. But by staying informed and vigilant, you can guard yourself against most fraudulent schemes.

Recognizing phishing attempts

Phishing often arrives in the form of emails or text messages that appear to be from your bank, asking you to click a link to verify personal information. Always check the sender’s email address, and if something feels off, call your bank directly to confirm. Remember: a legitimate institution will never ask for your password or PIN via email or text.

Reporting suspicious activity

If you notice strange charges on your statement or suspect someone has gained access to your account, call your bank immediately. Most have dedicated fraud departments that can freeze your account, issue new cards, or take other measures to protect your funds. The sooner you act, the better your chances of minimizing losses.

Common mistakes to avoid

We’re all human, and mistakes are bound to happen. However, learning from common slip-ups can help you dodge financial headaches down the road.

Neglecting to budget

A budget is like your financial roadmap. Without it, you risk wandering aimlessly, potentially overspending or missing key opportunities to save. If you’re trying to manage your bank account effectively, skipping a budget is one of the worst mistakes you can make.

Overspending

It’s easy to fall into the trap of overspending when you don’t monitor your transactions closely. Swiping a card can feel less tangible than paying with cash, so you might not notice just how much you’re spending on non-essentials until it’s too late. By reviewing your bank statements regularly, you can keep your spending in check and adjust as necessary.

Conclusion

Bank account management is like learning a new dance routine: awkward at first, but once you find the rhythm, it becomes second nature. From choosing the right account type to setting up alerts and notifications, each step is designed to help you track and optimize your finances. By staying organized, embracing digital tools, and learning from common mistakes, you’ll be well on your way to a harmonious financial life. Treat your bank account like a trusted friend—give it attention and care, and it will support you through every financial adventure.

Want to find out what Cobase can do for you?

Curious about how Cobase could streamline your bank account management? Picture consolidating all your accounts—from checking and savings to specialized business accounts—into one intuitive platform. Cobase helps you keep tabs on balances, automate routine payments, and track cash flows in real time, just like having a personal financial concierge at your fingertips. Instead of juggling multiple logins and statements, you can access everything under one dashboard, detect discrepancies faster, and save on fees through centralized oversight. Whether you’re a budding entrepreneur looking to level-up your financial organization or a finance pro tired of sifting through endless spreadsheets, Cobase is built to take the complexities out of multi-account management and let you focus on what truly matters: growing your business and securing your financial future.

Frequent Asked Questions (FAQs)

1. What’s the easiest way to avoid overdraft fees?

Link your checking account to a savings account so you have a financial safety net. You can also set up balance alerts to notify you when your account dips below a certain threshold.

2. Can I manage my bank account solely through a mobile app?

Yes, many banks offer robust mobile apps with the ability to deposit checks, pay bills, and monitor activity. Just remember to enable security features like two-factor authentication to keep your information safe.

3. How often should I reconcile my bank statements?

It’s best to do a quick check weekly or biweekly, and then a thorough reconciliation at least once a month when your statement arrives.

4. Do online-only banks offer better interest rates on savings accounts?

Often, yes. Because online banks don’t have the overhead costs of physical branches, they can typically pass those savings on to customers in the form of higher interest rates.

5. Is it okay to have multiple checking accounts for different purposes?

Absolutely. Many people find it beneficial to have separate accounts for day-to-day spending, bills, and special savings goals. Just keep track of fees and balances to avoid surprises.