New modules for Liquidity Forecasting and FX Exposure Management

Tue, Nov 3, 2020

We are proud to announce the launch of our new modules for Liquidity Forecasting and FX Exposure Management. Over the past year these new features have been developed and tested in co-creation with some of our thought leading customers. These modules will enable corporate treasuries to work in a highly efficient way to optimize cash positions or automatically hedge their FX risk on a continuous basis.

Budgets and expected future cashflows (accounts payable and receivable or other types of movements) can be entered into the Cobase system or uploaded directly from an ERP system. The Cobase system will then calculate and forecast cashflow. And combined with actual bank account balances, the Cobase system can also calculate and forecast account balances, all in a single currency or with multiple currencies.

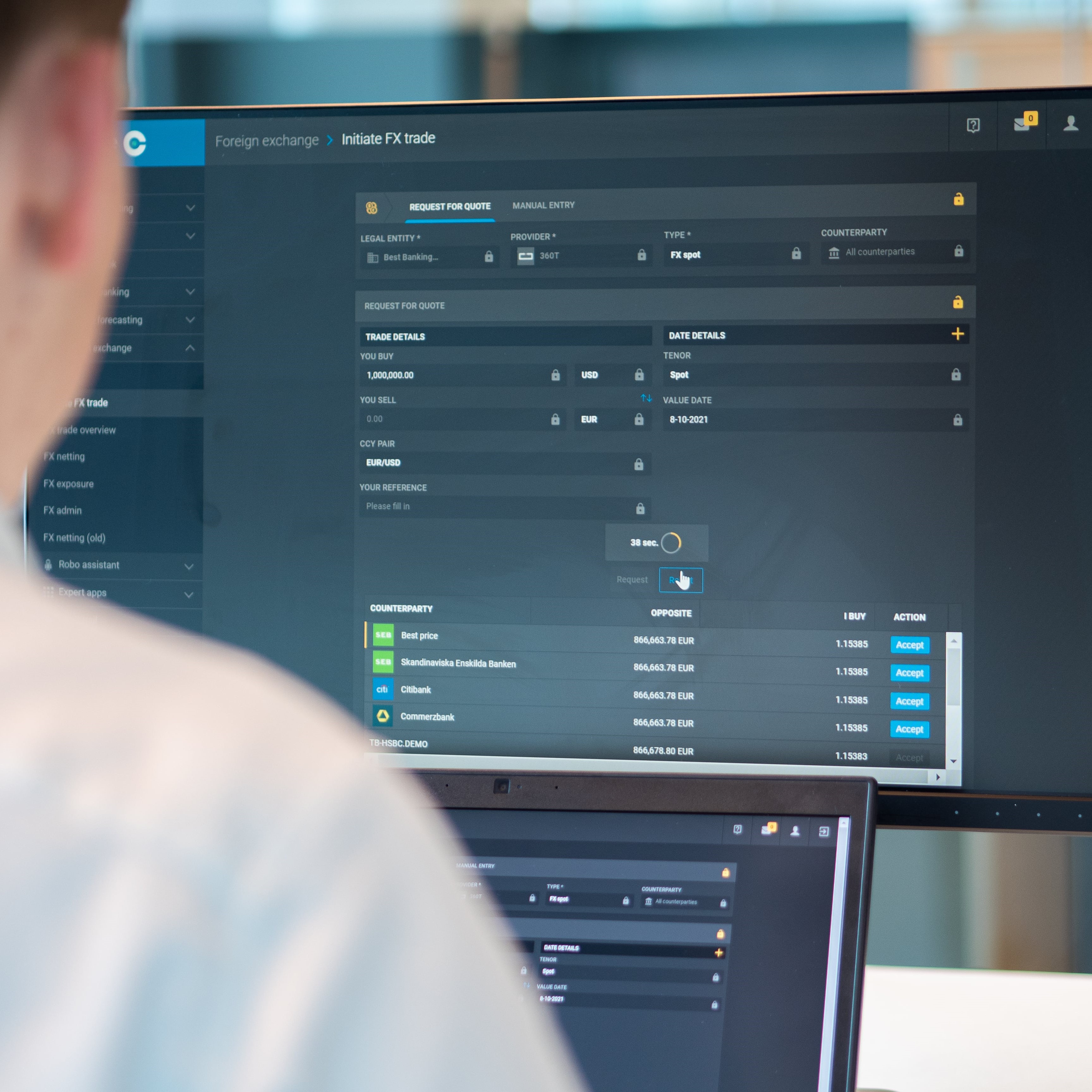

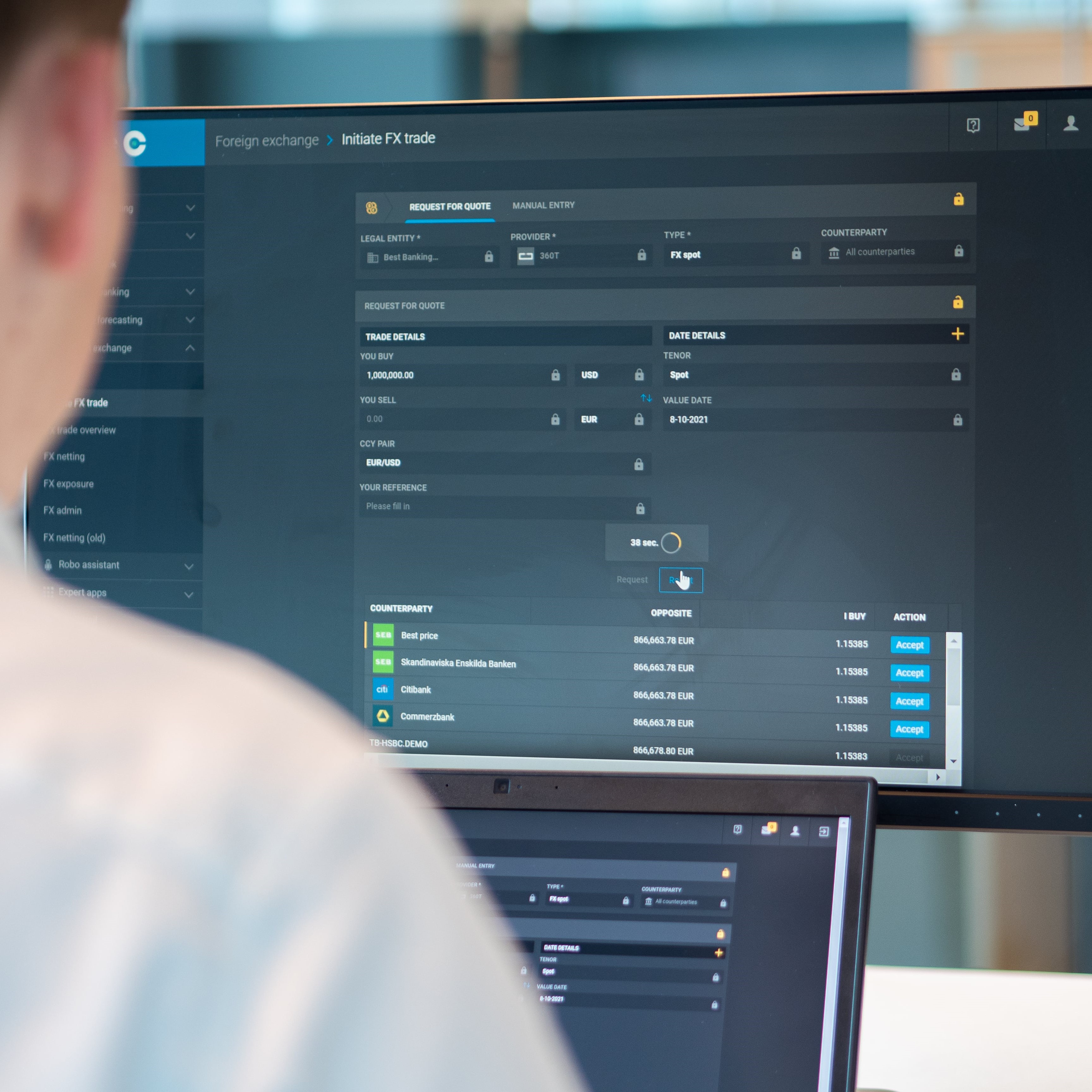

If the company has cashflows in foreign currencies, the FX module helps to manage FX risk and liquidity. Open FX risks are calculated and measured against the company’s own Hedging Policy. If the risk is not compliant with policy the module automatically calculates the required hedges to become compliant again and prepares the RFQ’s accordingly. The RFQ’s can then be sent to the FX Provider (bank or otherwise) for actual trading. All within the same platform environment.

The new Cobase modules give superior insight to the company’s liquidity position across time and currencies. They drastically simplify the FX risk management workflow from analysis to execution, support the full FX trade life cycle and reduce operational risk by removing the need to re-key financial data and automate risk calculations.

We are excited that these modules are now available and invite you to contact us for a demo or to join one of our webinars.